ad valorem property tax florida

It includes land building fixtures and improvements to the land. Often called property taxes.

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

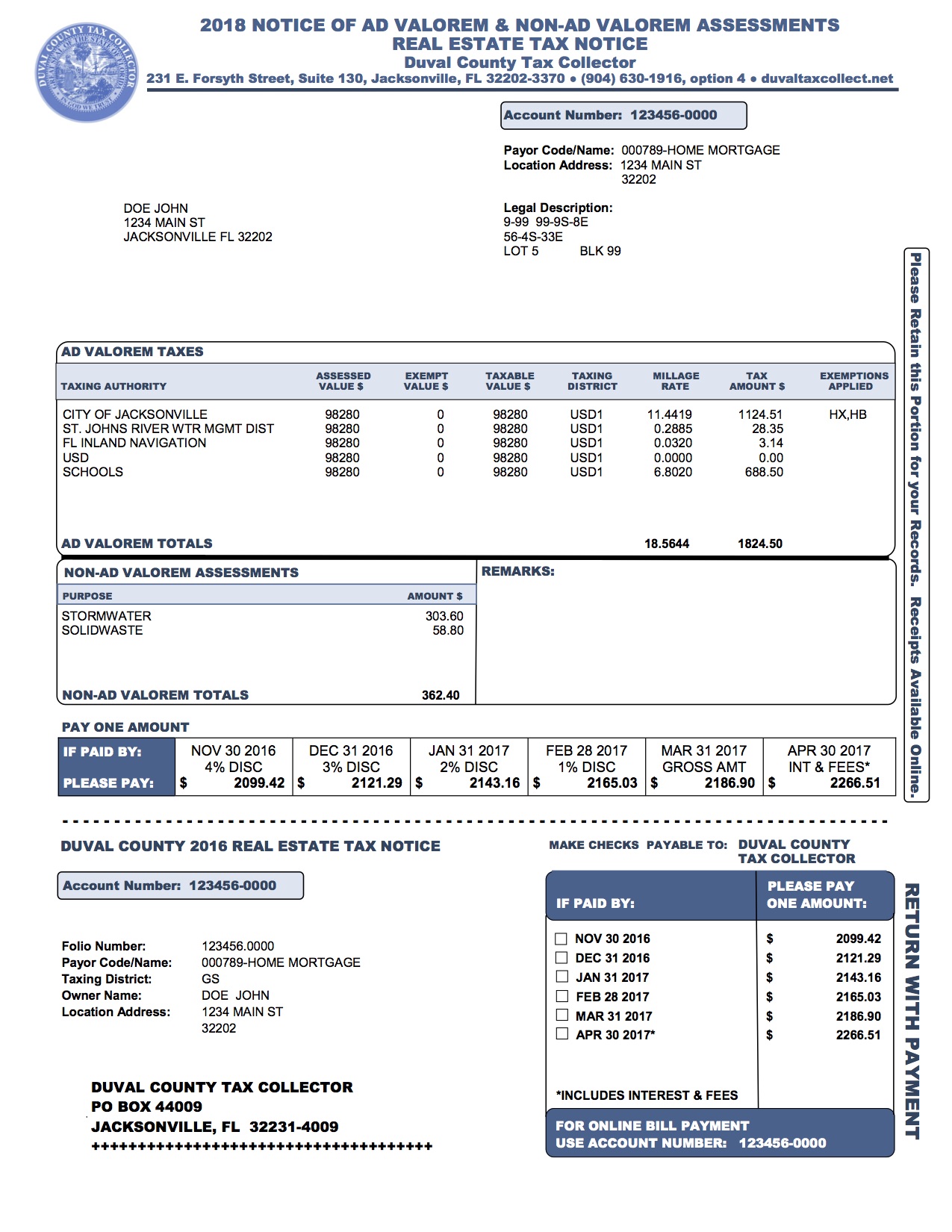

These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment.

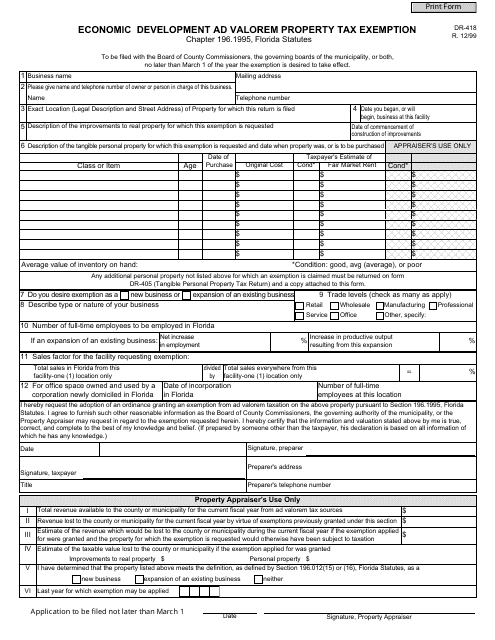

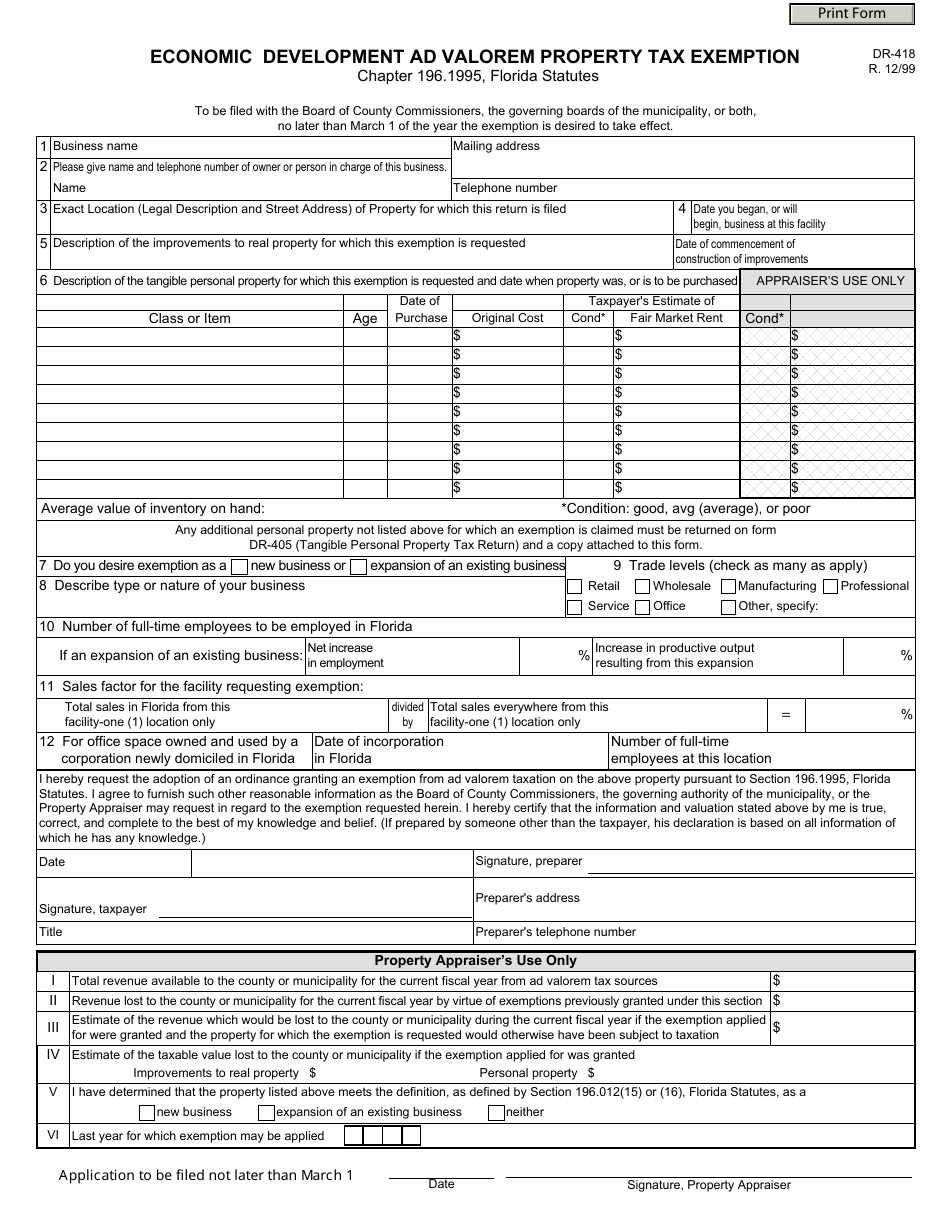

. The calculation is a bit involved but basically this is how it works. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. All owners of property shall be held to know that taxes are due and payable annually before April 1 st and are charged with the duty of ascertaining the amount of current and. The greater the value the higher the assessment.

The sovereign right of local governments to raise public money. They are levied annually. Ad valorem or property taxes are collected annually by the county tax collector.

Real property is located in described geographic areas designated as parcels. Authority for Non Ad Valorem. They determine the ownership mailing address legal description and value of the property.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Based on the assessed value of property. The total of these two taxes equals your annual property tax amount.

The most common ad valorem taxes are. Florida law divides property tax responsibilities between two separate agencies. Tangible Personal Property Taxes are an ad valorem tax assessed against furniture fixtures and equipment located in businesses and rental property.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Florida property taxes are relatively unique because. Authority for Ad Valorem Taxes.

Ad valorem taxes are added to the non-ad valorem assessments. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data. FL Taxpayers Ad Valorem Property Tax Exemption Upheld.

The Property Appraiser establishes the taxable value of real estate property. Florida Ad Valorem Valuation and Tax Data Book. Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through December.

Exemptions for Homestead Disability Widows and Agricultural Classifications are also determined by the Property Appraisers office. 3 if paid in December. By Jeanette Moffa Esq.

I will submit copies of my federal income tax returns for last year. A lien against property. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Under the Constitution Florida provides homestead property owners protection from forced sale by creditors and some ad valorem tax exemptions. Florida Property Appraisers notoriously can change their mind when it comes to exemptions even when those exemptions have been in place for years prior. Your propertys assessed value is determined by the Palm Beach County Property Appraiser.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. The Real Estate and Tangible Personal Property tax rolls are prepared by the Property Appraisers office. Real estate taxes comprise ad valorem taxes and non-ad valorem assessments while personal property taxes are solely ad valorem.

Using these figures the property appraiser prepares the tax roll. Tax bills are mailed on or around November 1 each year and discount periods allow you to save money by paying early. Santa Rosa County property taxes provide the fund local governments to provide.

Beyond these constitutional provisions Florida law grants a full ad valorem property tax exemption for homestead property owned by a veteran who sustained a total and permanent service-connected disability. In Florida property taxes and real estate taxes are also known as ad valorem taxes. 2 if paid in January.

On the tax roll. The millage rate is set by each ad valorem taxing authority for properties within their boundaries. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR NONPROFIT HOMES FOR THE AGED.

Taxes are normally payable beginning November 1 of that year. 3 Oversee property tax administration. Palm Beach County property taxes are calculated using your homes assessed value taxable value local millage rate ad valorem taxes and non-ad valorem taxes.

Ad valorem ie according to value taxes are. 4 if paid in November. I will provide other documents as required by the.

Ad Valorem Taxes. The Florida Constitution provides the power for the charter and non-charter counties as well as the municipalities to enact implement and enforce the measurement and service charges. Ad Valorem TaxesNon-Ad Valorem Taxes.

July 27 2019. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS. According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax.

The property appraiser assesses the value of a property and the Board of County Commissioners and other levying bodies set the millage rates. This assessment determines the amount of ad valorem taxes owed each year on your property. Taxes usually increase along with the assessments subject to certain exemptions.

I am applying to defer payment of a portion or all of the ad valorem taxes and any non-ad valorem assessments that would be covered by a tax certificate sold under Chapter 197 Florida Statutes for 20. Uniform throughout the jurisdiction. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

The property appraisers office and the tax. Ad Valorem taxes on real property and tangible personal property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through December. Ad valorem means based on value.

It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. Discounts are extended for early payment.

Article VII of the Florida Constitution and Chapters 192 193 194 195 196 197 200 and 201 of the Florida Statutes. Ad Valorem Property Tax If you own property in Florida that property is assessed annually by the county property appraiser. Section 1961975 Florida Statutes.

The ad valorem tax roll consists of real estate taxes tangible personal property taxes and railroad taxes.

Real Estate Taxes City Of Palm Coast Florida

Homestead Exemption Template Real Estate Agent Etsy Real Estate Agent Home Buying Checklist Real Estate Checklist

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Understanding Your Tax Bill Seminole County Tax Collector

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

County Property Tax Payment Deadline Jennifer Sego Llc

Broward County Property Taxes What You May Not Know

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

A Guide To Your Property Tax Bill Alachua County Tax Collector

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Time Is Running Out To Pay Your Property Taxes No Worries Stop By Avb Bank S Downtown Broken Arrow Location 322 S Main St Thi County Property Tax Bank

Real Estate Property Tax Constitutional Tax Collector

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller